Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is listed on the New York Stock Exchange under the symbol "TGT." We are authorized to issue up to 6,000,000,000 shares of common stock, par value $0.0833, and up to 5,000,000 shares of preferred stock, par value $0.01. As of March 2, 2023, there were 13,187 shareholders of record. Dividends declared per share for 2022, 2021, and 2020, are disclosed in our Consolidated Statements of Shareholders’ Investment.

On August 11, 2021, our Board of Directors authorized a $15 billion share repurchase program with no stated expiration. Under the program, we have repurchased 23.8 million shares of common at an average price of $223.52, for a total investment of $5.3 billion. As of January 28, 2023, the dollar value of shares that may yet be purchased under the program is $9.7 billion. There were no Target common stock purchases made during the three months ended January 28, 2023 by Target or any "affiliated purchaser" of Target, as defined in Rule 10b-18(a)(3) under the Exchange Act.

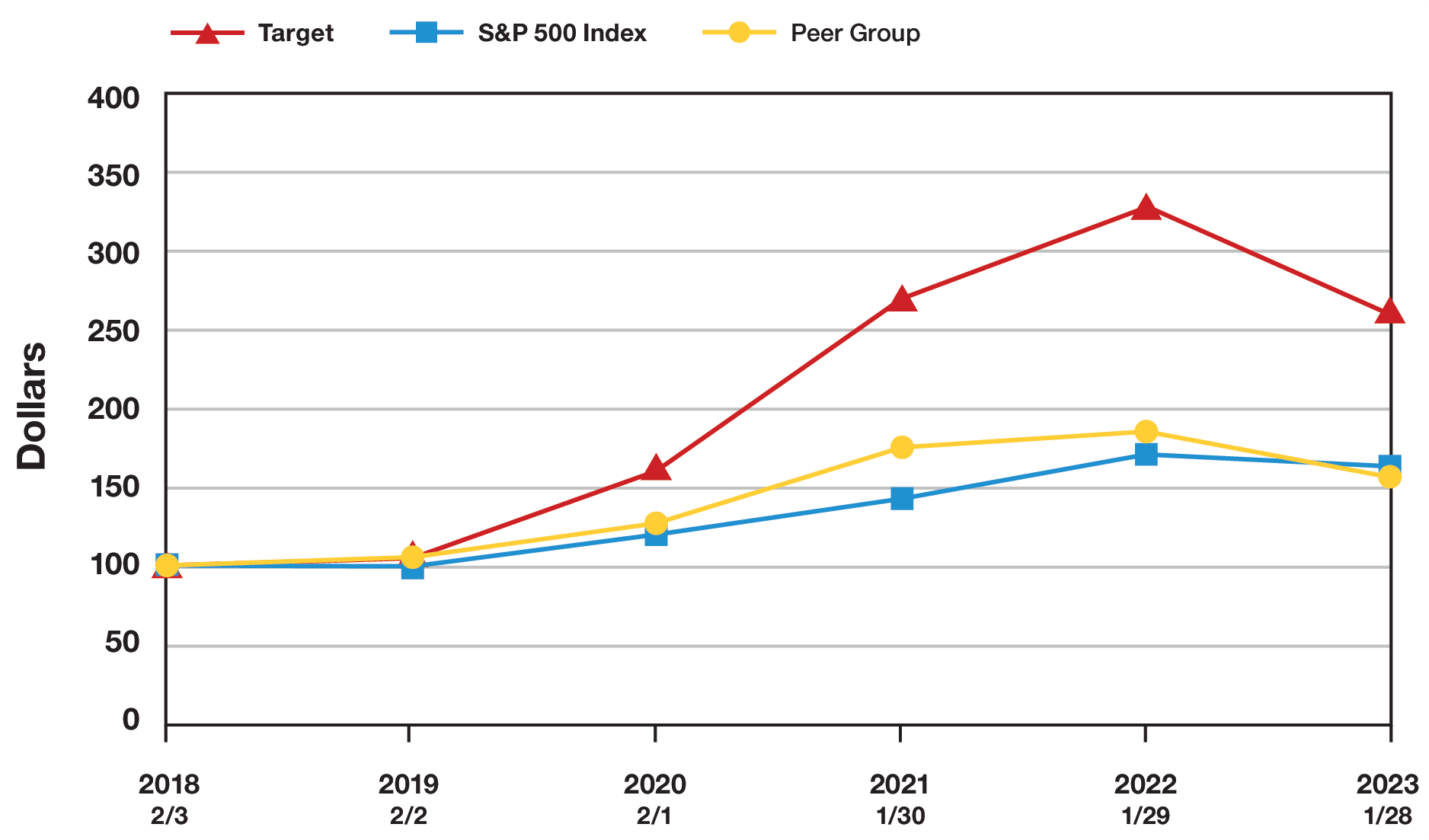

Comparison of Cumulative Five Year Total Return

| Fiscal Years Ended | ||||||

|---|---|---|---|---|---|---|

| February 3, 2018 | February 2, 2019 | February 1, 2020 | January 30, 2021 | January 29, 2022 | January 28, 2023 | |

| Target | $100.00 | $100.82 | $161.87 | $270.17 | $329.06 | $260.13 |

| S&P 500 Index | 100.00 | 99.94 | 121.49 | 142.45 | 172.36 | 160.94 |

| Peer Group | 100.00 | 104.28 | 126.36 | 175.31 | 183.63 | 156.02 |

The graph above compares the cumulative total shareholder return on our common stock for the last five fiscal years with (i) the cumulative total return on the S&P 500 Index and (ii) the peer group consisting of 19 online, general merchandise, department stores, food, and specialty retailers (Albertsons Companies, Inc., Amazon.com, Inc., Best Buy Co., Inc., Costco Wholesale Corporation, CVS Health Corporation, Dollar General Corporation, Dollar Tree, Inc., The Gap, Inc., The Home Depot, Inc., Kohl's Corporation, The Kroger Co., Lowe's Companies, Inc., Macy's, Inc., Nordstrom, Inc., Rite Aid Corporation, Ross Stores, Inc., The TJX Companies, Inc., Walgreens Boots Alliance, Inc., and Walmart Inc.) (Peer Group). The Peer Group is consistent with the retail peer group described in our definitive Proxy Statement for the Annual Meeting of Shareholders to be held on June 14, 2023, excluding Publix Super Markets, Inc., which is not quoted on a public stock exchange.

The peer group is weighted by the market capitalization of each component company. The graph assumes the investment of $100 in Target common stock, the S&P 500 Index, and the Peer Group on February 3, 2018, and reinvestment of all dividends.