This morning, Target announced our fourth quarter and full-year 2019 earnings results. Click here for the full results, read more about what's in store in 2020 and beyond, and see below for a snapshot of how we're continuing to move our strategy forward.

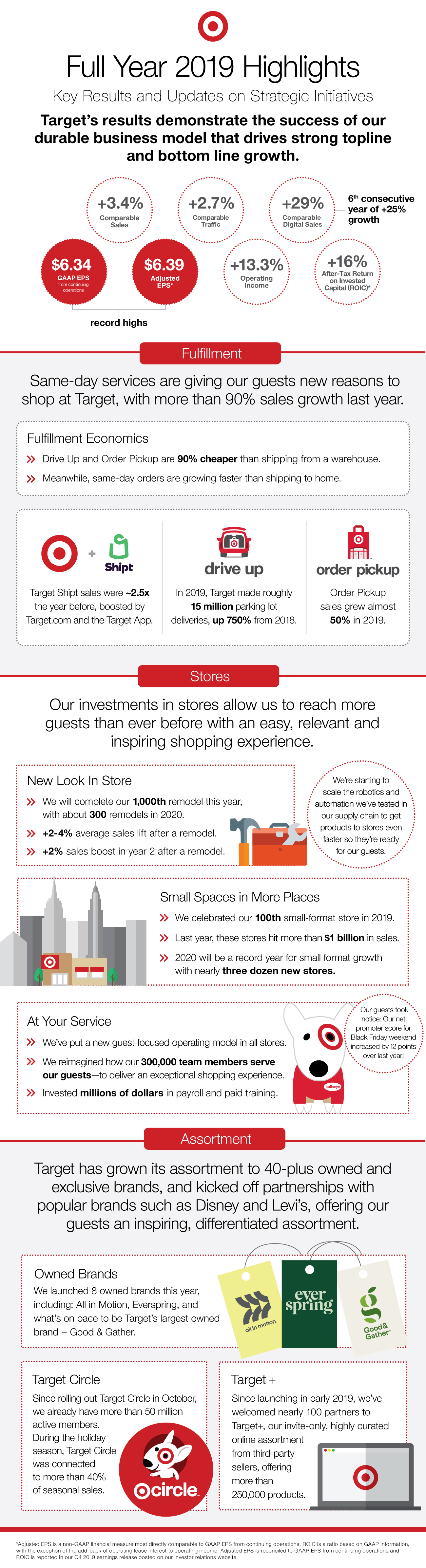

Full Year 2019 Highlights

Key Results and Updates on Strategic Initiatives

Target’s results demonstrate the success of our durable business model that drives strong topline and bottom line growth.

+3.4% Comparable Sales

+2.7% Comparable Traffic

+29% Comparable Digital Sales (6th consecutive year of +25% growth)

$6.34 GAAP EPS from continuing operations and $6.39 Adjusted EPS*—both record highs

+13.3% Operating Income

+16% After-Tax Return on Invested Capital (ROIC)

Fulfillment

Same-day services are giving our guests new reasons to shop at Target, with more than 90% sales growth last year.

Fulfillment economics:

Drive Up and Order Pickup are 90% cheaper than shipping from a warehouse.

Meanwhile, same-day orders are growing faster than shipping to home.

Target + Shipt: Target Shipt sales were ~2.5x the year before, boosted by Target.com and the Target App.

Drive Up: In 2019, Target made roughly 15 million parking lot deliveries, up 750% from 2018.

Order Pickup: Order Pickup sales grew almost 50% in 2019.

Stores

Our investments in stores allow us to reach more guests than ever before with an easy, relevant and inspiring shopping experience.

New Look In Store

We will complete our 1,000th remodel this year, with about 300 remodels in 2020.

+2-4% average sales lift after a remodel.

+2% sales boost in year 2 after a remodel.

We’re starting to scale the robotics and automation we’ve tested in our supply chain to get products to stores even faster so they’re ready for our guests.

Small Spaces in More Places

We celebrated our 100th small-format store in 2019.

Last year, these stores hit more than $1 billion in sales.

2020 will be a record year for small format growth with nearly three dozen new stores.

At Your Service

We’ve put a new guest-focused operating model in all stores.

We reimagined how our 300,000 team members serve our guests—to deliver an exceptional shopping experience.

Invested millions of dollars in payroll and paid training.

Our guests took notice: Our net promoter score for Black Friday weekend increased by 12 points over last year!

Assortment

Target has grown its assortment to 40-plus owned and exclusive brands, and kicked off partnerships with popular brands such as Disney and Levi’s, offering our guests an inspiring, differentiated assortment.

Owned brands: We launched 8 owned brands this year, including: All in Motion, Everspring, and what’s on pace to be Target’s largest owned brand – Good & Gather.

Target Circle: Since rolling out Target Circle in October, we already have more than 50 million active members. During the holiday season, Target Circle was connected to more than 40% of seasonal sales.

Target+: Since launching in early 2019, we’ve welcomed nearly 100 partners to Target+, our invite-only, highly curated online assortment from third-party sellers, offering more than 250,000 products.

*Adjusted EPS is a non-GAAP nancial measure most directly comparable to GAAP EPS from continuing operations. ROIC is a ratio based on GAAP information, with the exception of the add-back of operating lease interest to operating income. Adjusted EPS is reconciled to GAAP EPS from continuing operations and ROIC is reported in our Q4 2019 earnings release posted on our investor relations website.