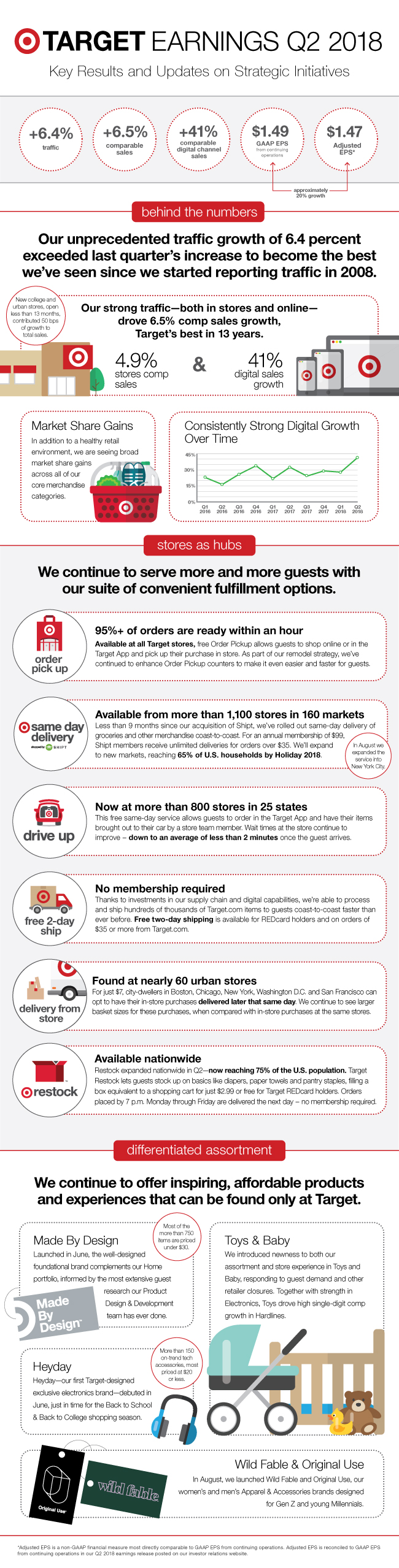

This morning, Target announced its second quarter 2018 earnings results. Click here for the full results and see below for a snapshot of how we're continuing to move our strategy forward.

stores as hubs

Order Pickup: 95%+ of orders are ready within an hour. Available at all Target stores, free Order Pickup allows guests to shop online or in the Target App and pick up their purchase in store. As part of our remodel strategy, we’ve continued to enhance Order Pickup counters to make it even easier and faster for guests.

Same-day Delivery: Available from more than 1,100 stores in 160 markets. Less than 9 months since our acquisition of Shipt, we’ve rolled out same-day delivery of groceries and other merchandise coast-to coast. For an annual membership of $99, Shipt members receive unlimited deliveries for orders over $35. We’ll expand to new markets, reaching 65% of U.S. households by Holiday 2018. In August we

expanded the service into New York City.

Drive Up: Now at more than 800 stores in 25 states. This free same-day service allows guests to order in the Target App and have their items brought out to their car by a store team member. Wait times at the store continue to improve – down to an average of less than 2 minutes once the guest arrives.

Free 2-Day Ship: No membership required. Thanks to investments in our supply chain and digital capabilities, we’re able to process and ship hundreds of thousands of Target.com items to guests coast-to-coast faster than ever before. Free two-day shipping is available for REDcard holders and on orders of $35 or more from Target.com.

Delivery from Store: Found at nearly 60 urban stores. For just $7, city-dwellers in Boston, Chicago, New York, Washington D.C. and San Francisco can opt to have their in-store purchases delivered later that same day. We continue to see larger basket sizes for these purchases, when compared with in-store purchases at the same stores.

Restock: Available nationwide. Restock expanded nationwide in Q2—now reaching 75% of the U.S. population. Target Restock lets guests stock up on basics like diapers, paper towels and pantry staples, filling a box equivalent to a shopping cart for just $2.99 or free for Target REDcard holders. Orders placed by 7 p.m. Monday through Friday are delivered the next day – no membership required.

differentiated assortment

We continue to offer inspiring, affordable products and experiences that can be found only at Target.

Made By Design: Launched in June, the well-designed foundational brand complements our Home portfolio, informed by the most extensive guest research our Product Design & Development team has ever done. Most of the more than 750 items are priced under $30.

Toys & Baby: We introduced newness to both our assortment and store experience in Toys and Baby, responding to guest demand and other retailer closures. Together with strength in Electronics, Toys drove high single digit comp growth in Hardlines.

Heyday: Heyday—our first Target-designed exclusive electronics brand—debuted in June, just in time for the Back to School & Back to College shopping season. More than 150 on-trend tech accessories, most priced at $20 or less.

Wild Fable & Original Use: In August, we launched Wild Fable and Original Use, our women’s and men’s Apparel & Accessories brands designed for Gen Z and young Millennials.