This morning, Target announced our third quarter 2019 earnings results. Click here for the full results and see below for a snapshot of how we're continuing to move our strategy forward.

Target Earnings Q3 2019

Key Results and Updates on Strategic Initiatives

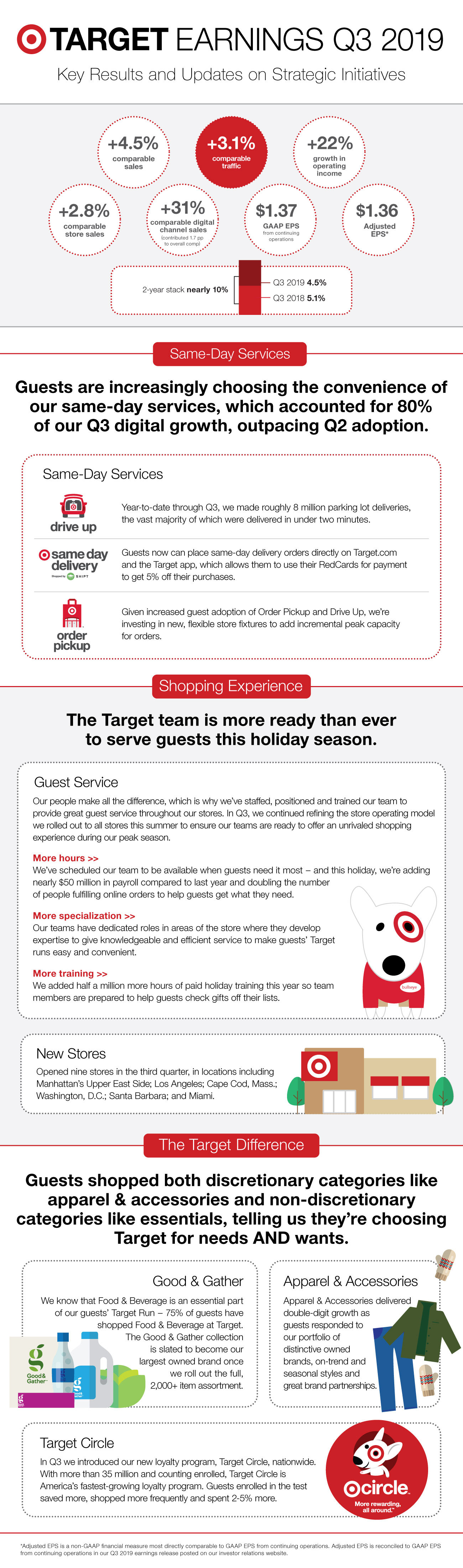

+4.5% comparable sales

+3.1% comparable traffic

+22% growth in operating income

+2.8% comparable store sales

+31% comparable digital channel sales (contributed 1.7pp to overall comp)

$1.36 Adjusted EPS*

$1.37 GAAP EPS from continuing operations

2-year stack nearly 10%; Q3 2019 4.5%, Q3 2018 5.1%

Same-day Services

Guests are increasingly choosing the convenience of our same-day services, which accounted for 80% of our Q3 digital growth, outpacing Q2 adoption.

Drive Up: Year-to-date through Q3, we made roughly 8 million parking lot deliveries, the vast majority of which were delivered in under two minutes.

Same-day delivery shopped by Shipt: Guests now can place same-day delivery orders directly on Target.com and the Target app, which allows them to use their RedCards for payment to get 5% o their purchases.

Order Pickup: Given increased guest adoption of Order Pickup and Drive Up, we’re investing in new, flexible store fixtures to add incremental peak capacity for orders.

Shopping Experience

The Target team is more ready than ever to serve guests this holiday season.

Guest Service: Our people make all the difference, which is why we’ve staffed, positioned and trained our team to provide great guest service throughout our stores. In Q3, we continued refining the store operating model we rolled out to all stores this summer to ensure our teams are ready to offer an unrivaled shopping experience during our peak season.

More hours: We’ve scheduled our team to be available when guests need it most – and this holiday, we’re adding nearly $50 million in payroll compared to last year and doubling the number of people fulfilling online orders to help guests get what they need.

More specialization: Our teams have dedicated roles in areas of the store where they develop expertise to give knowledgeable and efficient service to make guests’ Target runs easy and convenient.

More training: We added half a million more hours of paid holiday training this year so team members are prepared to help guests check gifts o their lists.

New Stores Opened nine stores in the third quarter, in locations including Manhattan’s Upper East Side; Los Angeles; Cape Cod, Mass.; Washington, D.C.; Santa Barbara; and Miami.

The Target Difference

Guests shopped both discretionary categories like apparel & accessories and non-discretionary categories like essentials, telling us they’re choosing Target for needs AND wants.

Good & Gather

We know that Food & Beverage is an essential part of our guests’ Target Run – 75% of guests have shopped Food & Beverage at Target. The Good & Gather collection is slated to become our largest owned brand once we roll out the full, 2,000+ item assortment.

Apparel & Accessories: Apparel & Accessories delivered double-digit growth as guests responded to our portfolio of distinctive owned brands, on-trend and seasonal styles and great brand partnerships.

Target Circle: In Q3 we introduced our new loyalty program, Target Circle, nationwide. With more than 35 million and counting enrolled, Target Circle is America’s fastest-growing loyalty program. Guests enrolled in the test saved more, shopped more frequently and spent 2-5% more.

*Adjusted EPS is a non-GAAP ‑nancial measure most directly comparable to GAAP EPS from continuing operations. Adjusted EPS is reconciled to GAAP EPS from continuing operations in our Q3 2019 earnings release posted on our investor relations website.